We're investors, not traders.

Quality investments, diversified by sectors.

We invest in holdings you WANT to own

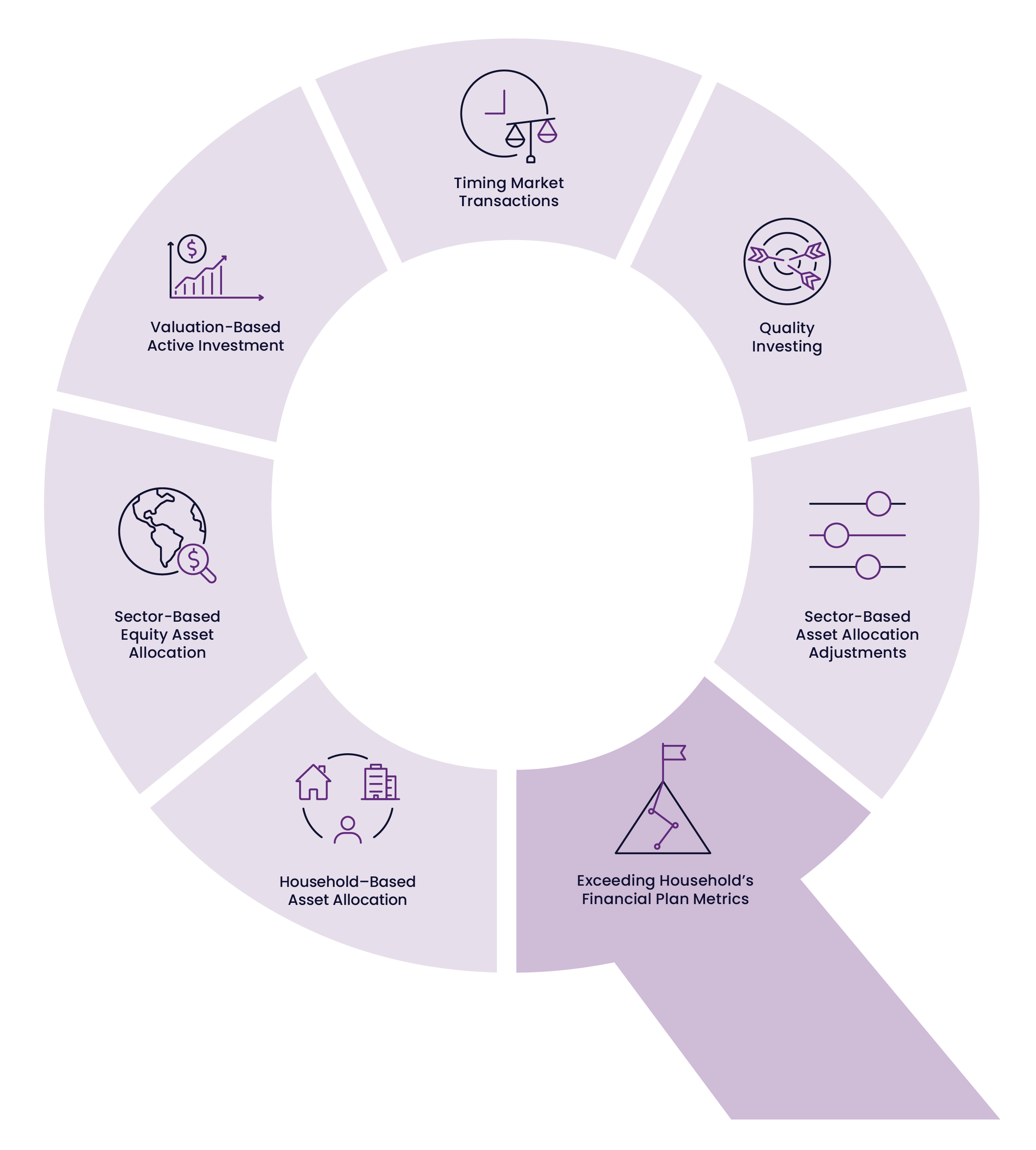

Our methodology resonates with owner-operators, entrepreneurs and all types of professionals because our definition of quality investing aligns with the attributes they strive to achieve in their business. We call this approach QSect – short for Quality Sector, looking for high-quality holdings on a sector-by-sector basis independent of geography.

TriCert Investment Counsel is registered as a Portfolio Manager with the Ontario Securities Commission (OSC) in Ontario, its principal regulator, and with each relevant securities administrator in all other jurisdictions across Canada. TriCert Investment Counsel Inc. is registered as an Investment Fund Manager in Ontario.

Investment Principles

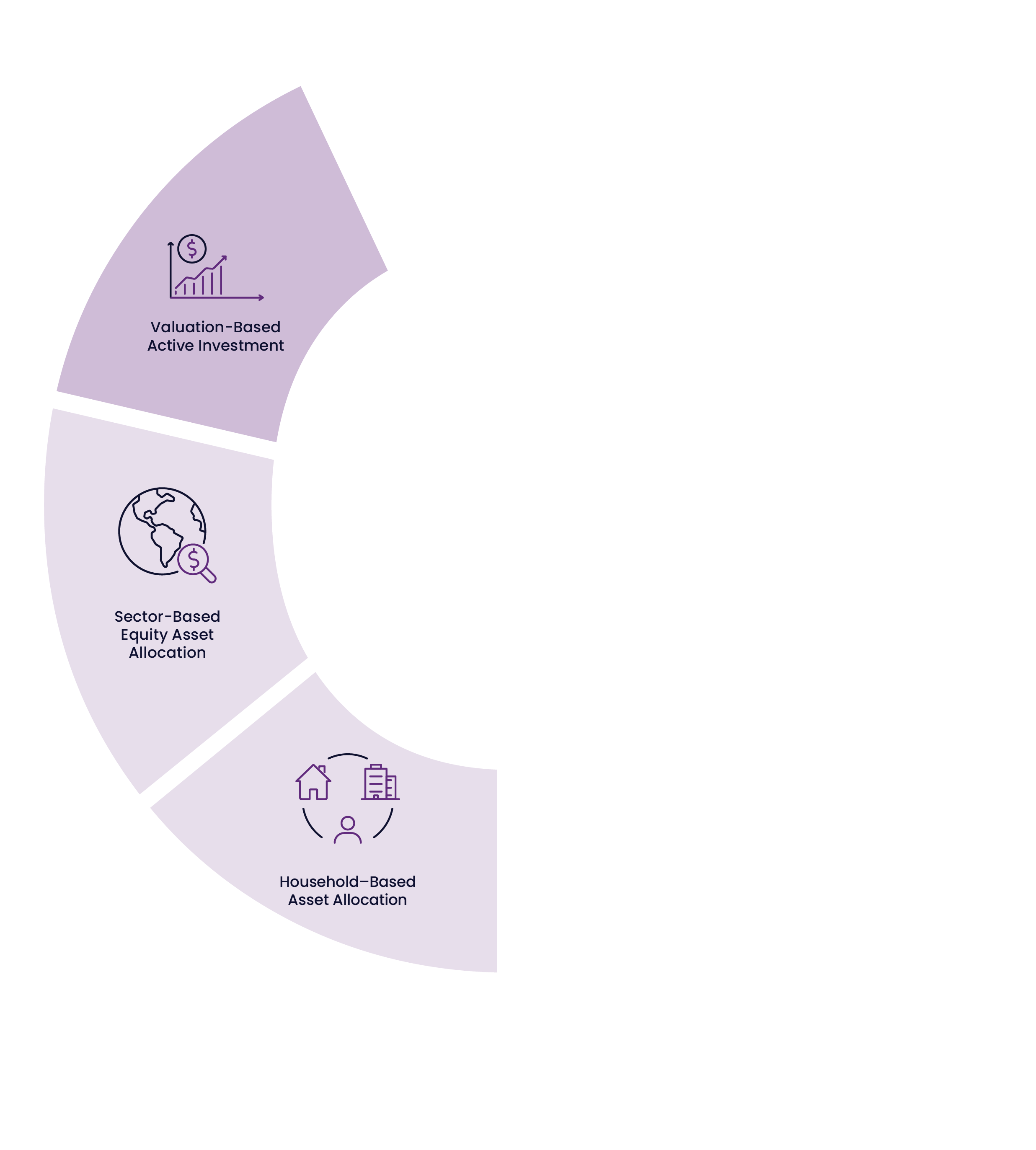

Our QSect approach is based upon a series of investment principles that guide our portfolio management team.

Navigate through our seven guiding principles. →

In this episode of InFocus, Mike Gassewitz, CEO of TriCert Financial Group, is joined by Brian Durno, CFP®, CFA®, Lead of the Investment Management and Strategy Group at TriCert Investment Counsel.

Listen as they delve into the concept of quality within the QSect approach. The conversation navigates the complex terrain of defining quality in investment management, emphasizing factors such as revenue stability, competitive threats, market share, and the distinction between growth and value creation. Brian sheds light on the team’s methodology in evaluating companies, stressing the importance of qualitative and quantitative analysis and the significance of paying the right price for quality investments. The episode underscores the resilience of quality businesses, exemplified by their consistent dividend growth even in volatile market conditions.

Investment Solutions

We apply our QSect approach to our client’s portfolios based on their unique goals, circumstances and, most importantly, their risk profile. For clients who are early in their journey, we utilize a series of portfolios and our QSect private pools. For clients well along their way, we create portfolios with individual equities and income producing holdings that enable an even higher level of customization as well as streamlined tax loss/gain harvesting.

Let us guide you on a journey to financial growth and peace of mind.

Get a deeper dive into our investment approach.

Investment insights

TD Bank’s Setbacks and an Update on the Financial Sector

In this episode of InFocus, TriCert Financial Group CEO Mike Gassewitz speaks with TriCert Investment Counsel Portfolio Manager Lee Grimshaw, CFA®, about the financial sector’s performance over the past quarter.

Market Movers: Technology and Industrials Insights

In this episode of InFocus, TriCert Financial Group CEO Mike Gassewitz and TriCert Investment Counsel Portfolio Manager Dave Gill, CFA®, MBA, discuss the performance of the Industrials and Technology sectors.

The Stability of Consumer Staples: Resilience in Volatile Markets

In this episode of InFocus, guest host Candis Fitch, CIM®, CIWM, Portfolio Manager at TriCert Investment Counsel, welcomes Chief Investment Officer and Portfolio Manager Brian Durno, CFP®, CFA®, to discuss the unique role of consumer staples in investment portfolios.