We designed the ADꓯPT process for the insurance industry's harshest critics - accountants

A needs and priorities-based approach that is commission-agnostic.

Unbiased, commission-agnostic, and professional insurance advice

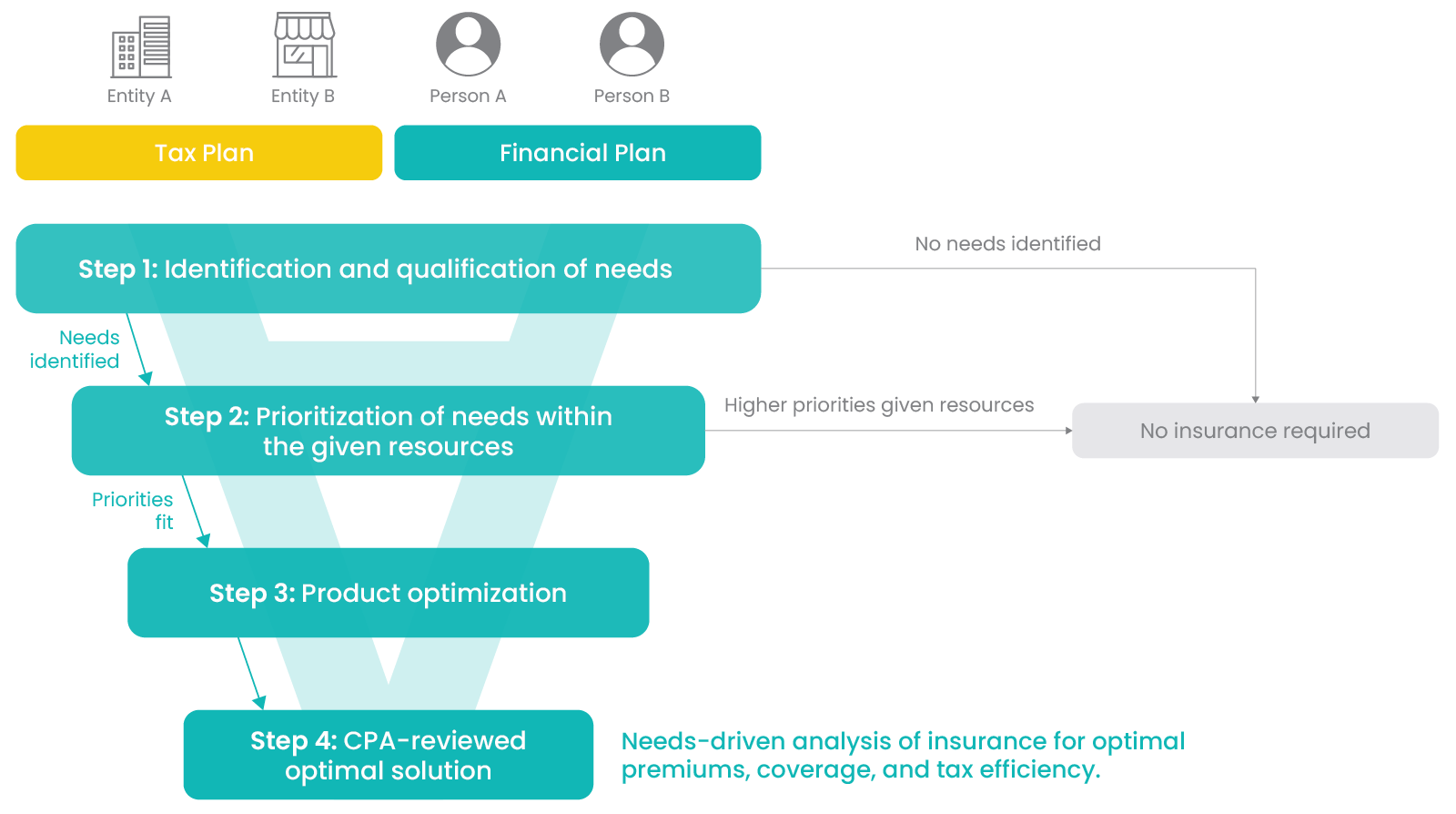

To address the insurance stigma, TriCert Insurance Agency designed the proactive ADⱯPT diagnostics process to satisfy the insurance industry’s harshest critics – accountants.

Our insurance team conducts a meticulous impact analysis to understand the potential effects on personal and corporate cash flow in the event of death or disability. Our experts will also model future tax liabilities to identify how we can reduce those liabilities with an optimal insurance solution.

TriCert Insurance Agency’s proactive ADꓯPT diagnostic takes into account the needs and priorities when evaluating the suitability of insurance in a client’s portfolio.

ADꓯPT stands for Accountants Diagnostic for All Protection and Tax-Efficiency.

ADꓯPT: The Accountants’ diagnostics process

To learn more about the diagnostics process and what our experts do at every step, read about our Diagnostics process.

Insurance Services

Listen to our case studies

For past recorded media, Independent Accountants’ Investment Counsel (IAIC) is now TriCert Investment Counsel and Independent Accountants’ Life Insurance Agency (IALIA) is now TriCert Insurance Agency.

ADꓯPT saved a client $1.3M

This content has been prepared by TriCert Insurance Agency Inc. The information and opinions presented in this presentation are for general information only. It should not be considered as professional advice or a recommendation. Any opinions in this presentation are...

When Purchasing Additional Life Insurance is NOT Recommended

This content has been prepared by TriCert Insurance Agency Inc. The information and opinions presented in this presentation are for general information only. It should not be considered as professional advice or a recommendation. Any opinions in this presentation are...

When Insurance Doesn’t Make Sense – A Real-Life Example

This content has been prepared by TriCert Insurance Agency Inc. The information and opinions presented in this presentation are for general information only. It should not be considered as professional advice or a recommendation. Any opinions in this presentation are...

Insurance insights

For past recorded media, Independent Accountants’ Investment Counsel (IAIC) is now TriCert Investment Counsel and Independent Accountants’ Life Insurance Agency (IALIA) is now TriCert Insurance Agency.

Webcast: ADꓯPT, The Accountants’ Proactive Process

Watch this webcast, with Oliver Lee, VP of Life & Living Benefits at TriCert Insurance Agency and Mike Gassewitz, President & CEO at TriCert Financial Group, to learn more about our disciplined, proactive approach to insurance.

Educational Series Podcast: Life Insurance Q&A Part 3

In this In Focus Educational Series episode, Portfolio Manager Candis Fitch, CIM®, CIWM, sits down with Oliver Lee, Vice President of Life Insurance & Living Benefits at Independent Accountants’ Life Insurance Agency Inc. (IALIA).

Listen as they discuss common questions about Life Insurance for businesses; Why a business may need to purchase life insurance. Does an owner/operator need business and personal insurance? And what types of products should business owners consider?

Educational Series Podcast: Life Insurance Q&A Part 2

In this In Focus Educational Series episode, Portfolio Manager Candis Fitch, CIM®, CIWM, sits down with Oliver Lee, Vice President of Life Insurance & Living Benefits at Independent Accountants’ Life Insurance Agency Inc. (IALIA).

Listen as they discuss more common questions about Life Insurance; I have a medical issue and won’t qualify, what should I do? Should I get insurance when I’m younger vs. older? And how can life insurance be used to help with a family farm transfer to only one child?