Hate insurance? So does your accountant

The Accountants’ diagnostics process

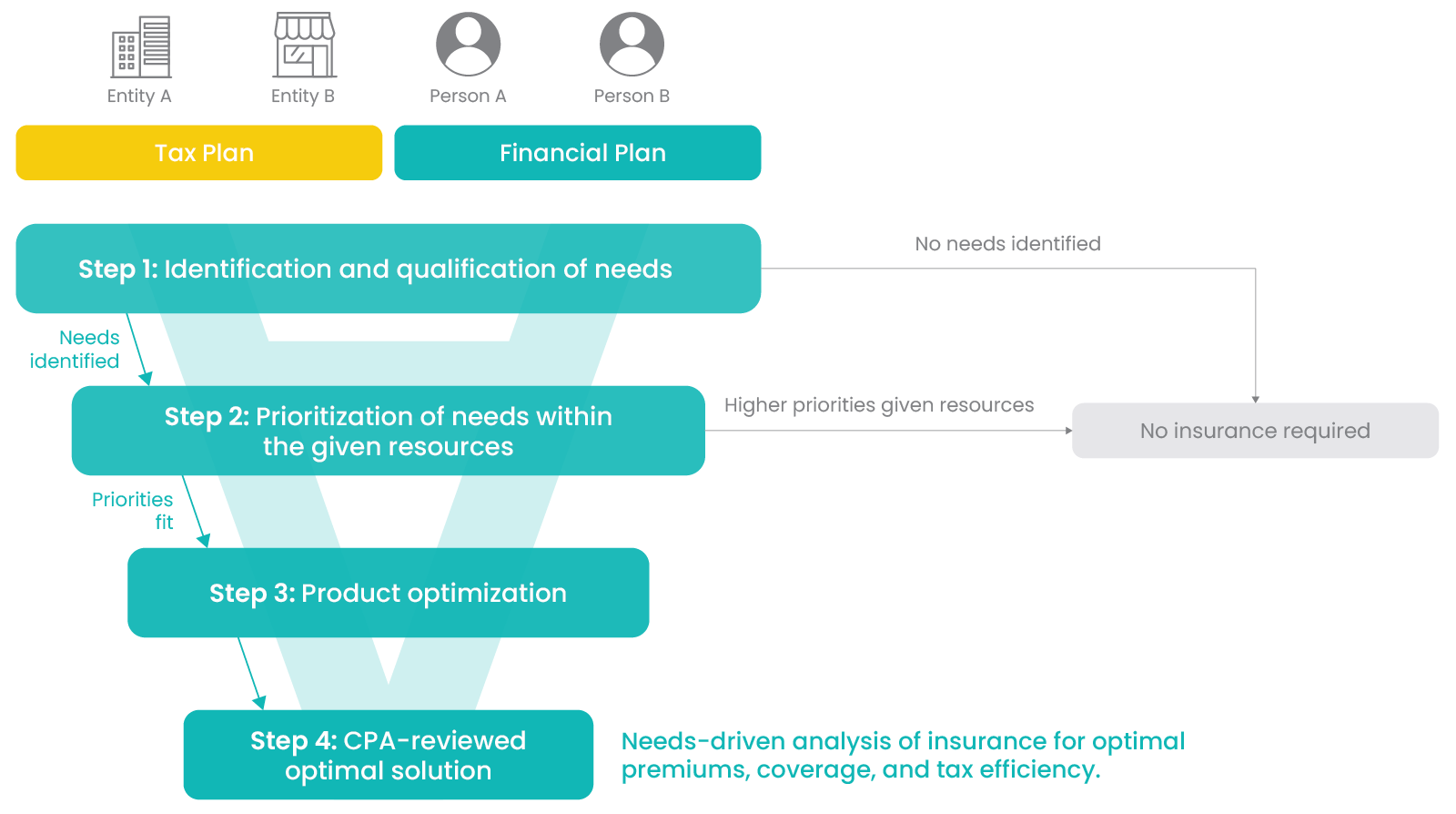

4-Step Insurance Analysis

Step 1: Identification and Quantification of Needs

The initial phase of ADⱯPT (Accountants Diagnostic for All

Protection and Tax-Efficiency) Diagnostics revolves around the discernment and measurement of insurance requirements. Two primary factors are examined here:

- Protection Need: This involves a meticulous impact analysis, determining the potential ramifications on both personal and corporate cash flow in the event of death or disability.

- Tax Minimization Need: By modelling future tax liabilities, the agency can accurately compute possible tax reductions associated with the insurance.

If the diagnostics do not pinpoint any particular needs, then there’s no necessity for insurance at this stage.

Step 2: Prioritization of needs within the given resources

Once the needs are identified, the process delves into their prioritization, considering the available resources. This involves a careful examination of the client’s funding capacity and how insurance aligns with other financial planning goals, such as debt reduction, savings, and business growth.

If the higher-priority financial goals consume all the available resources, insurance might not be deemed necessary.

However, if there’s alignment between identified needs and available resources, the process proceeds to the next stage.

Step 3: Product optimization

Step 3 focuses on tailoring the best insurance product for the client. In this stage, TriCert Insurance Agency finds the best product, carrier, and commission-neutral stance, ensuring that the solutions provided are entirely in the client’s best interests. The solutions brought forward are CPA-reviewed, ensuring optimal insurance coverage, premiums, and tax efficiency for the client.

In essence, the ADⱯPT insurance diagnostics process by TriCert Insurance Agency ensures that clients are only presented with insurance solutions that genuinely resonate with their unique financial situations and goals.

Step 4: CPA-reviewed optimal solution

Needs-driven analysis of insurance for optimal premiums, coverage, and tax efficiency.

We do insurance differently

We can provide an impact analysis to understand the effects on personal and corporate cash flow in the event of death or disability. Our experts will also model future tax liabilities to identify how we can reduce those liabilities with an optimal insurance solution.